Market Data Infrastructure

We build turn key market data infrastructure solutions for brokers and exchanges

- Expandable services

- Robust performance

- Easy configuration

- Scalable infrastructure

- Interoperability

- Low latency technology

Market Data Infrastructure Solutions

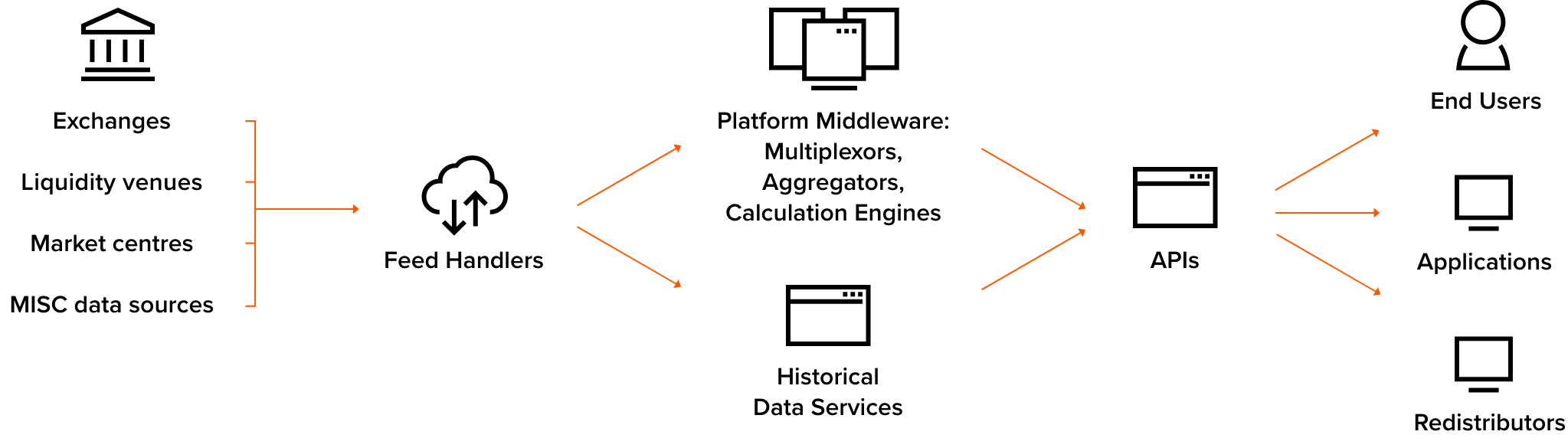

Devexperts provides managed infrastructure solutions to stream, store and control market data from exchanges, market data centers and participants worldwide as well as custom client-generated data.

Fast & secure data streaming

Our solutions support secure streaming and snapshot delivery of real-time, delayed, historical, chart, calculated and reference market data in B2B (downstream subscriber or sub-vendor data feed delivery), B2C (client facing infrastructures) and B2B2C (full cycle) modes to a virtually unlimited number of clients.

Flexible deployment

We support cloud deployment in public (Amazon Cloud, Google Cloud, Microsoft Azure, IBM Cloud), private or hybrid clouds as well as low-latency infrastructures in proximity colocations in the data centers where the exchanges and market participants systems are deployed.

Turn-key service

We are ready to provide the full-featured ticker plant with services and functions configured and pre-installed according to the client’s needs and provide 24×7 customer support. In addition, we can provide full lifecycle assistance with research and design, general consulting and project management.

Market data content types:

- Real-time

- Delayed

- Historical

- Calculated

- Reference

- Custom

- Data aggregation

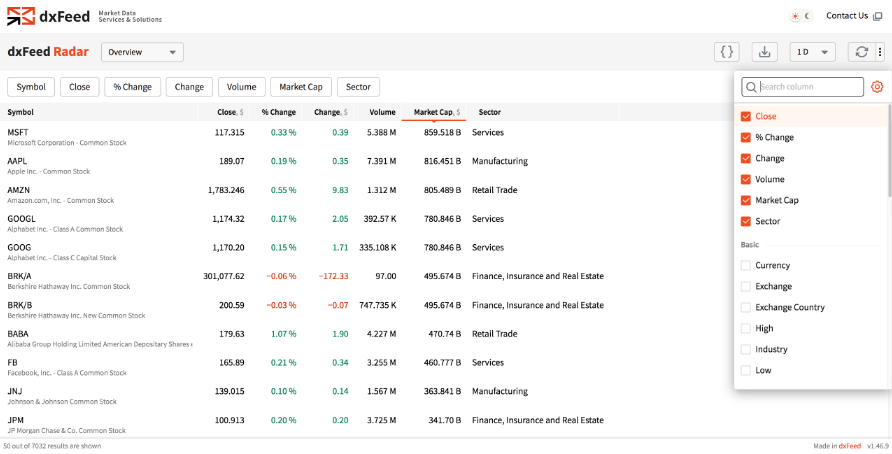

Wide range of APIs:

- C/C#

- JavaScript

- Python and R

- Java

- REST

- FIX

Multiple asset classes:

- Equities

- ETFs

- Futures

- Equity options

- Indices

- FX

- Crypto

Ticker plant architecture

Market data infrastructure

provides the following services out of the box:

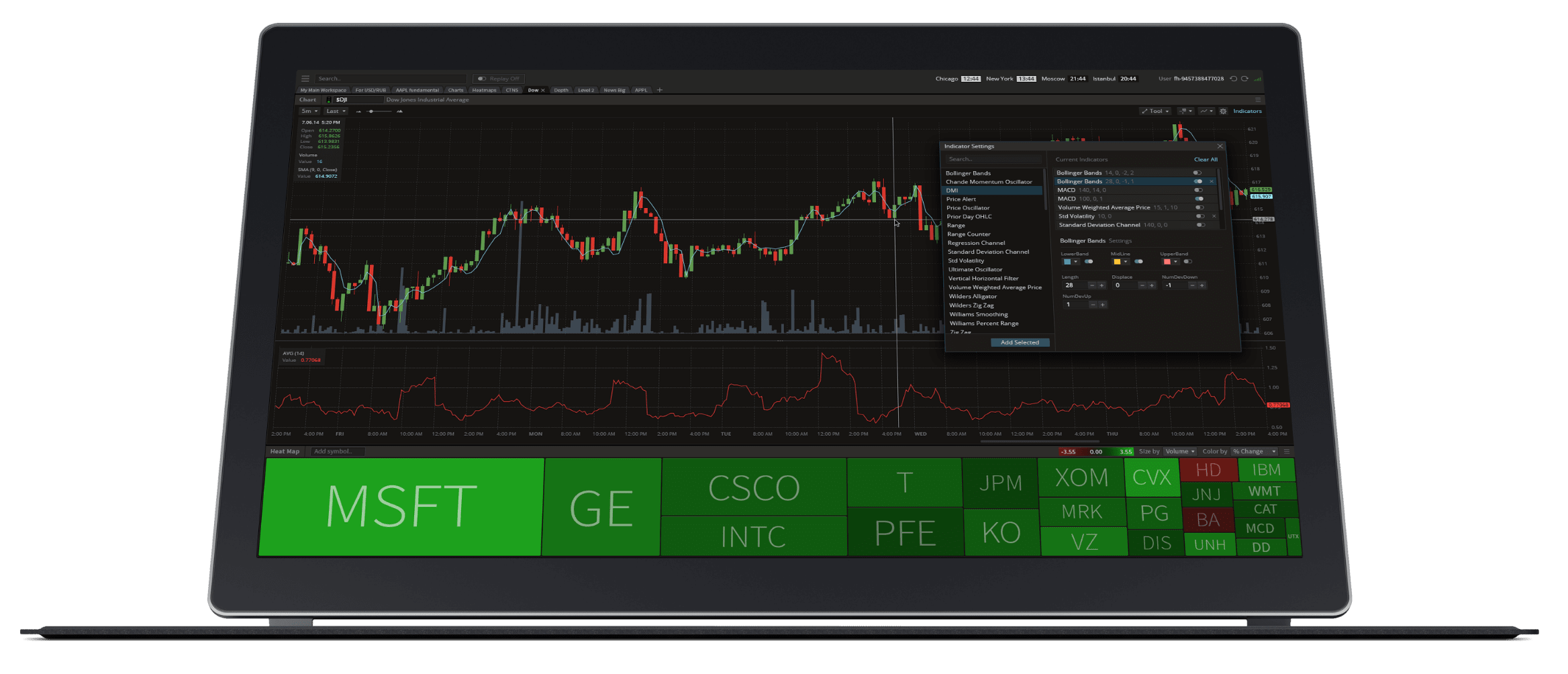

Alert Service

Charting Service

Fundamentals

News

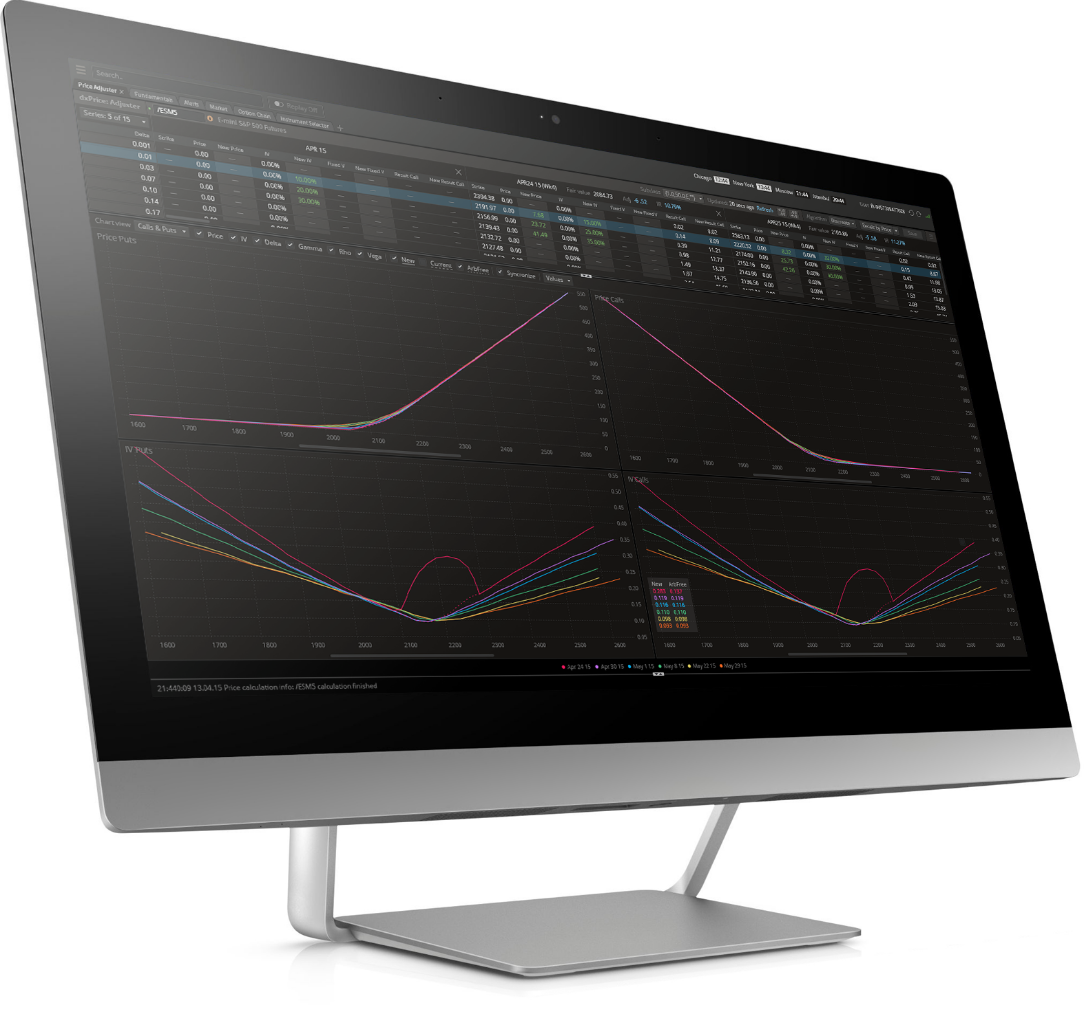

Theoretical Options Prices

Instrument Profile Format Service

Our clients

In our portfolio there are projects for different financial markets and geographical areas, different regulations and different asset classes.

Some of our implementations are owned by reputable brokers in both institutional and retail segments.