Forex Risk Management & Pre-Trade Control

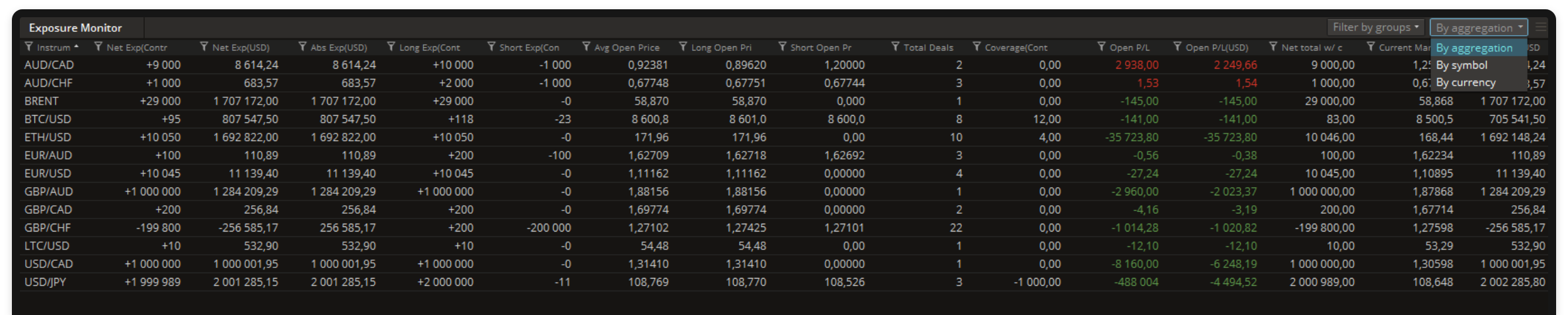

Real-Time Exposure Monitoring

Hedge client exposures automatically or directly from the exposure monitor

Enter manual hedges to accurately monitor hedging on 3rd party platforms

View exposures on both currency and currency pair levels

Advanced filtering for monitoring individual groups or account positions

Track and manage overall risk through total Net Open Position (NOP)

Monitor broker hedging positions from a dedicated widget

Execution Settings

Execution rules

Manage A/B book settings on client, instrument and group levels

Smart order routing rules

Set trades above a certain threshold for manual execution

Exposure limits

Set exposure limits on the account and/or instrument levels to manage risk exposure

Speed bump settings

Manage toxic flow and latency arbitrage by throttling orders

Tiered margining settings

Manage risk from larger trade sizes

Margin settings

Comply with differing regulatory margin requirements and set margins at symbol, group, and individual client levels

Price collars

Automatically identify and reject off-market trades

Kill switch

Manage worst-case scenarios, cancel all orders, and prevent new positions being opened

Price Management

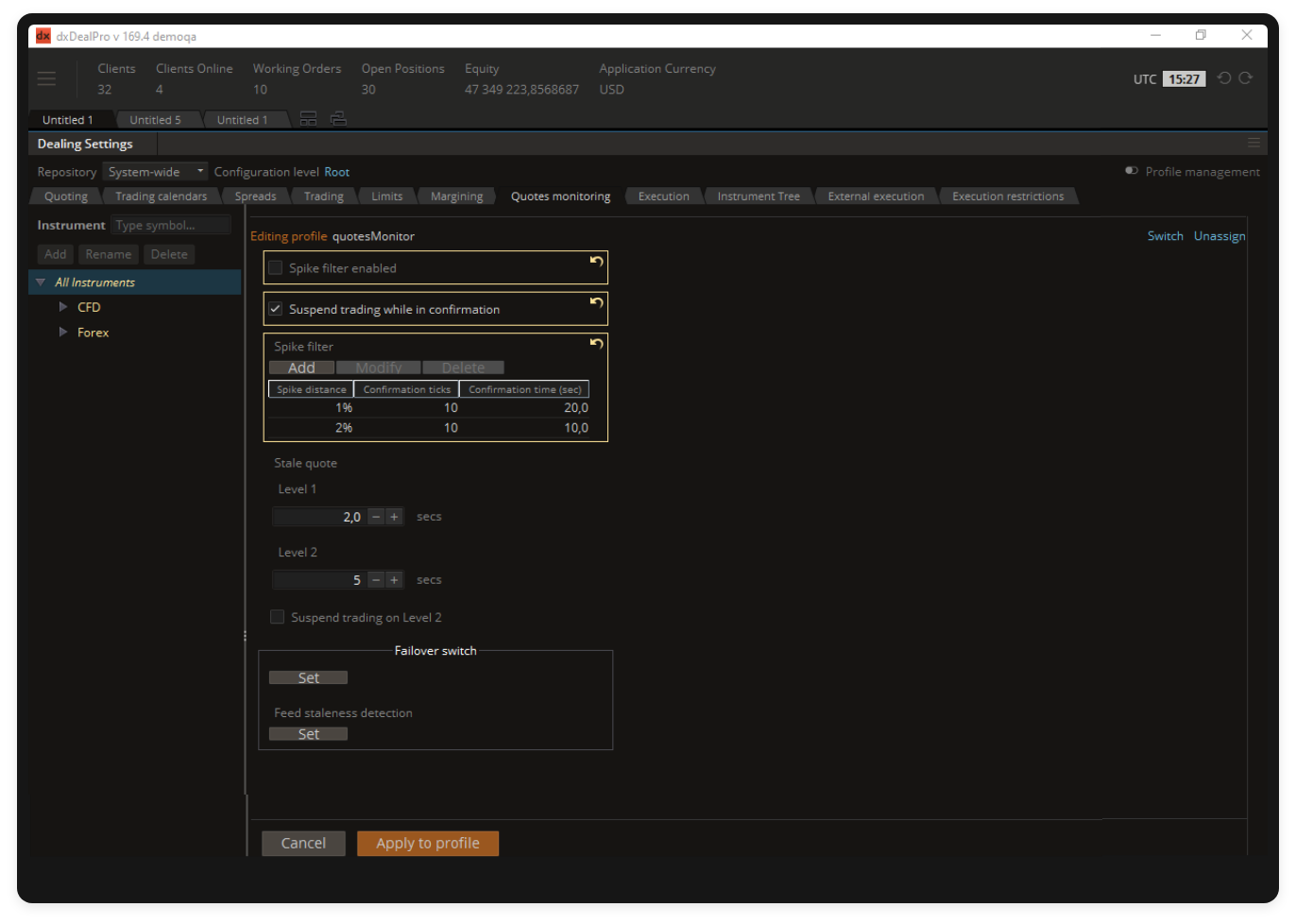

Stale quotes monitor

Automatically prevent clients from trading on

off-market or old prices

Spike filtration tools

Prevent from receiving off-market prices

Automated failovers

Prevent pricing downtime and reduce the risk of stale pricing

Account Management

Manage and monitor your accounts

Everything you need to manage and monitor client accounts. All widgets pop-out allowing brokers to monitor multiple accounts, groups, or metrics in real-time. Account tagging allows brokers to create custom tags to monitor high volume or abusive traders using our multi-level filtering from every widget.

Trading Calendar

Avoid any issues with setting trading hours or market holidays with a trading calendar. Brokers can set individual or multiple trading sessions for a single or group of instruments. The trading calendar also removes complications surrounding different markets as instrument schedules can be set using UTC, GMT, or London/New York time zones.

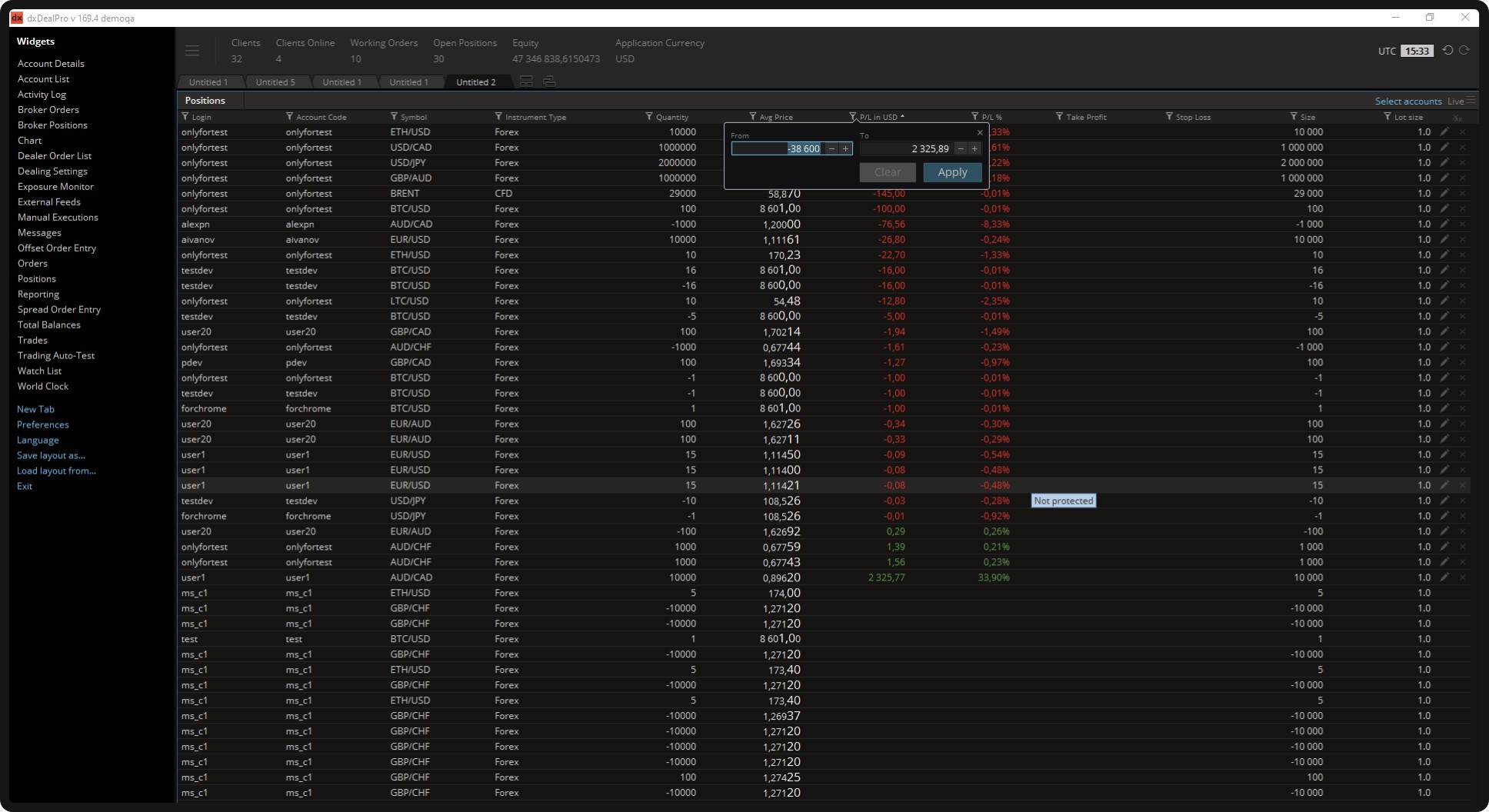

Manage your clients’ positions and trade on their behalf

Trade on behalf of clients with the ability to place pending orders and market orders at the current market rates or fill orders at a specific price. Trading on behalf can be carried out from the account, account list, position list, or order list widgets.

Maintain visibility on your positions with broker views

The Dealing Module offers views of positions and orders from both client and broker views, allowing brokers to manage their positions (A/B book) and exposures without any confusion.

Let us help you with your business challenges

Contact us to schedule a call or set up a meeting