About the Client

The client offers asset management and investment advice to financial advisors and their customers. The firm manages customer portfolios and facilitates incorporating options into investments to manage risk. In practice, the process spans from placing buy and sell orders, execution with a custodian to options attribution and performance reporting.

Before engaging in these activities, our client needs to find partners/ customers. The client then has to generate and negotiate proposals and track agreement status.

Business Challenge

The client needed to streamline pre-sales and new customer generation and negotiation procedures. Their processes relied on manual data input, mostly across separate Excel spreadsheets, which is time-consuming and labor-intensive. This, coupled with broad data sources and large data quantities for processing, limited the client’s productivity. It also restricted how well they could track account creation and agreement status.

The challenge was bi-fold, though. Once the client engaged with a new customer, the inconvenient UI didn’t facilitate configuring strategy attributes since it included many irrelevant fields, not unified on one single portal. The interface was complex; advisors had to refer to multiple documents to gather the information they needed. This, in turn, didn’t simplify performance monitoring.

Instead, the client wanted a convenient web-based portal/UI which grouped all their former tools and databases in one place with a good looking, fast user interface.

The system would also allow third-party access to data for performance assessment and analysis and options strategy simulation. As an added benefit, the software needed to simplify and improve internal operations management.

Finally, time-sensitive and privacy-sensitive data weren’t handled properly. Data updates weren’t frequent enough: they only happened daily. The client also couldn’t grant access to junior employees without exposing sensitive data. This made data accuracy and security an issue.

Solution

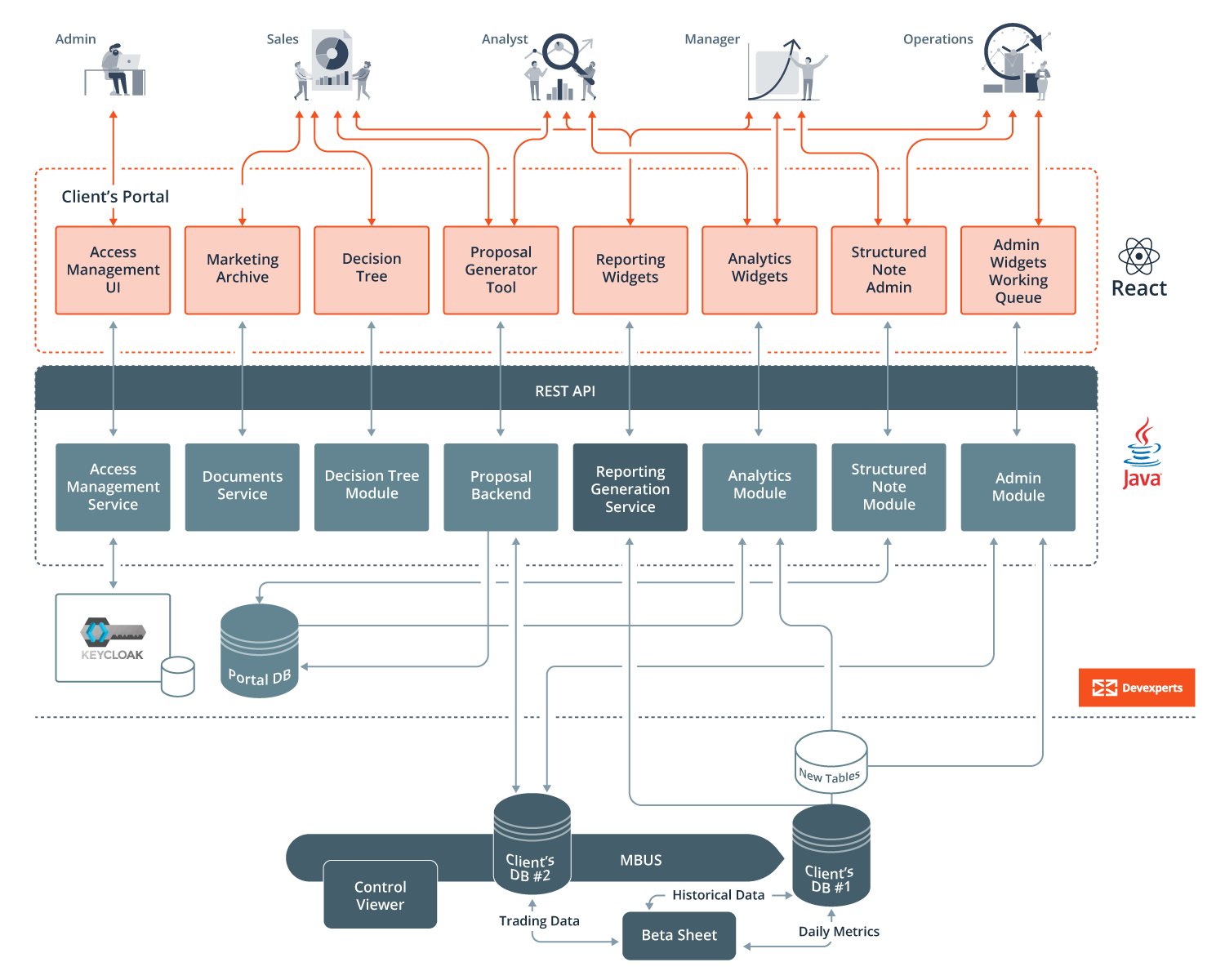

The client approached Devexperts to create software that would help them improve operational management and sales processes. They also sought our expertise to build a UI that offered structured notes using options.

The project was challenging due to its broad scope since the software required an API and a user-friendly UI for internal and third-party use. That’s why we decided to group the deliverables based on task priority—primary and secondary.

Primary Deliverables

We started implementing systems for separating access and authorizations based on user. The initial phase also targeted automating proposal generation and creating a widget for the work queue.

We created a client portal with improved UI to simplify user inputs and queries. It included different accessibility options for the various entities using the UI. The solution sourced information from the client’s Excel databases into one fast and efficient portal. Each entity was also only able to view the dashboards relevant to it. For example, only the operations team would need access to the Work Queue widget to ensure workflow optimization. Admins as well wouldn’t need any work-related dashboards. Instead, they’d need to view access management portals.

The solution also enabled the client to use the white-label reporting widget to generate analytics and invoices quickly.

The second solution created at this level was the Work Queue. The feature tracks all changes employees and customers make to all the data, such as customer user information, equity holdings, option strategy, etc. It tracked all changes in the portal mentioned above. Then, it alerted the relevant entities to approve/ reject the changes. The client could even request additional work from employees or customers before approving changes. We even went a step further, creating automations that generate triggers based on predetermined conditions. These would prompt the relevant entities to perform additional work to complete any given task.

Secondary Deliverables

We then moved on to the secondary project deliverables to offer better analytics and access to data. The solution used Java and Python scripts to analyze the client’s historical data and generate daily performance reports. We created multiple modules to split processes and ensure they function most efficiently.

One module is the admin module, which validates and simplifies user input. It also helps with form submission and strategy creation.

Another module we delivered is the proposal generation tool. The solution automates data retrieval from customer databases and market data providers, such as Bloomberg. We created a web UI to help customers input equity ticker information and select their preferred portfolio management strategy. This tool is also linked back to the Decision Tree module to help the client choose the appropriate option strategy for that specific customer.

We also went deeper, allowing the client to use the tool to create a final report showing the financial benefit to customers of adopting the proposed option strategy. The PDF report included all data and graphs relevant to submit a sales offer to prospective customers.

For existing customers, we created a performance reporting tool to help our client generate specific financial performance reports. The client could choose the timeframe and the specific parameters to include in the final PDF report. All information would also be presented in a table or graph form.

Results

Ultimately, we helped the client scale the sales process and provide option strategies to multiple customers. The new UI empowered the client’s sales team to generate proposals easily and improve service consistency. The client could create and manage customer information. The solution also helped the client define competitive fees and allocate client-specific portfolio strategies.

Aside from the sales process, the widget and dashboard improved the client’s day-to-day operational management. In effect, it simplified all processes and services the asset manager offers. The Work Queue solution helped the client track all changes and automate which information flows to the databases. It even helped the client identify work requirements and create work triggers to the relevant entity.

The proposal generation and reporting tools helped the client combine all information into clean reports in a friendly PDF format. This helped improve the decision-making process for option strategy selection. It also aided in pinpointing financial benefit to potential customers and tracking financial performance for active clients.

All of this funneled into the client’s structured note replications beating S&P 500 returns. It also allowed the client to buffer or even reverse the downside in normalized market conditions.

The solution also helped the client deliver their options strategies and overlays at competitive prices. This, in return, gave it a competitive advantage over other investment advisors.